Further Changes to the Approval for International Transfer Process

On 24 April 2023, the South African Revenue Service (SARS) released new enhancements to the Tax Compliance Status (TCS) process, with immediate effect. The changes made by SARS mainly concerned the approvals required by individuals when transferring funds out of South Africa. Now, SARS has made further changes – but what are these changes, and why do they matter?

Lovemore Ndlovu

Head of SARB Engagement and Expatriate Compliance

A TCS PIN from SARS, under the category “Approval International Transfer” (or “AIT”), is required where a tax resident seeks to transfer more than R1 million from South Africa in a calendar year. For tax non-residents, every cent of capital to be remitted will (barring certain exceptions) require an AIT approval.

Introduction of the AIT Process

Previously, a taxpayer would request TCS approval from SARS based on “Emigration” or by using their “Foreign Investment Allowance”. On 24 April 2023, these application types were subsumed into the AIT TCS process, requiring taxpayers to detail their tax residency status, along with substantial new information requirements. These information requirements included disclosure of the taxpayer’s local and foreign assets and liabilities to SARS, as well as the sources of the amount to be transferred.

The New AIT Changes

On 30 October 2023, SARS stated that it has adjusted the TCS PIN process relating to the Approval International Transfer (AIT) applications “to address feedback from stakeholders”.

SARS states that the new changes made aim to enhance the efficiency and accuracy of the AIT TCS PIN process. At face value, these appear to be welcome changes which address previous shortcomings which made the process somewhat cumbersome and inconsistent. In summary, the new changes are as follows:

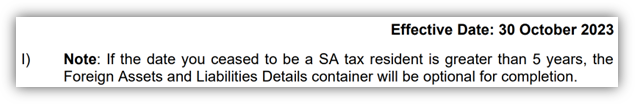

Foreign Assets & Liabilities

Previously, details on the taxpayer’s foreign assets and liabilities were a mandatory requirement for inclusion in their application to SARS. However, it remained in question whether SARS was entitled to request such information in cases where the taxpayer was already a non-resident for a period of time.

Per SARS’ statement, all fields under the “Foreign Assets and Liabilities Details” container of the online application form have been made optional, albeit based on the date that the taxpayer ceased to be a South African tax resident. According to the newly updated SARS Guide TCS, this will apply to those taxpayers who ceased to be tax residents more than 5 years prior to the date of their AIT TCS PIN application.

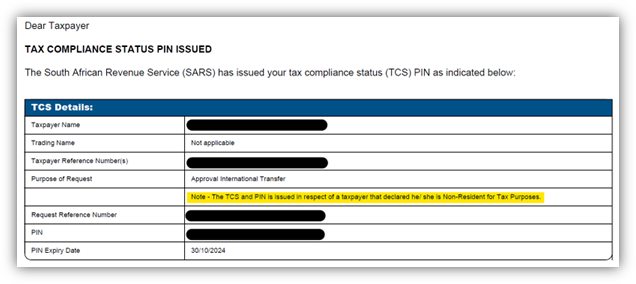

AIT Approval Details

Where the taxpayer has received AIT approval, the associated document (PIN) will now display the residency status under which the application was approved.

According to SARS, this addition enhances transparency and accountability by clearly documenting the taxpayers’ tax residency status at the time of approval.

TCS Verification Dashboard

When an AIT TCS PIN approval is granted, the authorised dealer (i.e., bank) transferring the funds is required to verify that the taxpayer does indeed have permission to make the international transfer. This is done by verifying the AIT TCS PIN on SARS’ e-Filing.

With this in mind, one of the new changes made to the AIT process is the addition of an “Amount” column added to the TCS verification dashboard. According to SARS, this enables AIT TCS PIN approvers and reviewers to view the total value of the international transfer per the AIT TCS PIN application made, including in cases where the application has not yet been approved.

This provides a more comprehensive view of the financial data associated with the AIT TCS PIN application, to allow for more well-informed decisions and/or conclusions.

Other Notable Changes

Further to the above significant changes, SARS has further amended the AIT TCS PIN application process to replace the “Net Worth” field, under the “Assets and Liabilities Details” container, with “Net Amount (at cost)” in the application form. This appears to provide a clearer understanding of the information being requested, as it is not accurate to classify one’s net worth based on the cost value of their assets.

The “Trust No.” and “Passport No. of Main Trustee/Representative Taxpayer of the Trust” fields, under the “Local and Foreign Trust Details” container in the form, as well as the “Local and Foreign Loan to a Trust Details” container, have been made optional when “Foreign Trust” is selected. This modification seems to simplify and differentiate the application process for those involved with foreign trusts.

Also relative to trusts, the “Trust No.” field under the “Distribution from Trust Additional Details” container has been made optional when “Foreign Trust” is selected. This change seems to offer more flexibility for applicants dealing with foreign trusts.

Finally, with reference to the “Sale of Shares and Other Securities Details” container, the “Share code” and “Number of shares sold” fields have been disabled where “Listed Shares” is selected as the source of the amount to be transferred.

The Devil in the Details

One would agree that the latest adjustments made by SARS demonstrate a proactive approach to addressing stakeholder feedback and ensuring a more user-friendly and robust TCS approval system.

However, the level of detail required by SARS in AIT TCS PIN applications still begs unwavering accuracy in the disclosures made, especially given the criminal implications which underpin false declarations made (whether intentional or negligent), for both taxpayers and tax practitioners alike.

While the new changes are welcome, applicants should remain weary and remember to measure twice and cut once with their disclosures, and engage a qualified tax practitioner or attorney where possible.