Tax Residence Certificates for SA Expats: SARS’ way or the highway

Many South African (SA) expats already recognize that the Notice of Non-Resident Tax Status Letter (the letter) is their golden ticket to confirming their cessation of tax residency. A Tax Residence Certificate (TRC) from one’s new country of residence provides substantial evidence that one is now resident for tax purposes in their new country, aiding in allowing them to then cease tax residency in South Africa.

Roxanna Naidoo

Global Partner & Client Engagement

Nikolas Skafidas

SARS Tax Compliance and Process Supervisor

While it is not a legal requirement to obtain a TRC from your new country of residence when ceasing tax residency in SA, SARS has made it clear that this is now a listed requirement in order to obtain the letter.

Understanding One’s Tax Residency Status

Determining one’s tax residency status holds paramount importance for South Africans ceasing their tax residency. South Africans are categorized into two tax groups: residents and non-residents. Residents are taxed on their worldwide income, while non-residents are only taxed on income sourced within South Africa. Declaring a non-resident tax status involves a formal process that requires clear documentary evidence supporting the permanent intention to reside abroad. This evidence must be submitted to SARS in request to formalize the cessation of tax residency. The process remains administratively burdensome, requiring individuals to substantiate their intent to reside abroad permanently with reference to objective factors and supporting documentation. One crucial requirement is the request for a Tax Residence Certificate (TRC) from the individual’s current country of residence, further confirming their presence in their new country of residence.

What is a Tax Residence Certificate (TRC)?

A TRC is a document issued by the Revenue Authority of the other jurisdiction where a taxpayer is resident, in order to prove their tax residence in that country for a particular tax year(s). This document usually stipulates the date that one is seen to be a tax resident of that country. This TRC does not necessarily mean that one is actively paying taxes in that country, but rather indicates residency for tax purposes, demonstrating that the country they now reside in has a taxing right over one’s income. The significance of a Tax Residence Certificate (TRC) lies in its role as documented confirmation of an individual’s tax residency status in a foreign country. It plays a pivotal role in ascertaining which country has the right to tax an individual’s earnings and provides concrete evidence to other tax authorities and relevant institutes.

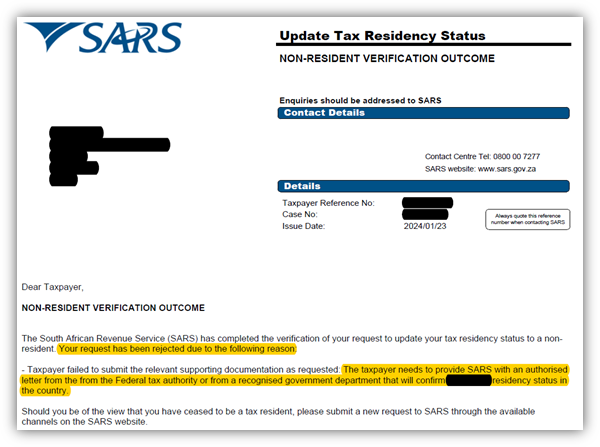

Avoid SARS Rejections

Although not a legal requirement, in practice, we have consistently observed that SARS requests a Tax Residence Certificate when applying for a Notice of Non-Resident Tax Status Letter. There are various reasons why some expats are unable to obtain a TRC, including if one is not earning income in that country or if that country’s tax regulations do not make provisions for a TRC. Failure to provide this TRC to SARS has led to rejections by SARS, citing “failure to provide supporting documentation” as the reason for rejection. We collaborate with in-country tax partners across the globe who are well-versed in their country’s tax landscape and fully equipped to assist with obtaining TRC’s for South African expatriates.

Where one is unable to obtain a TRC, we also work closely with in-house tax attorneys to engage SARS from a legal standpoint to mitigate SARS rejections by ensuring your application is treated within the relevant legal requirements.

Tax laws can vary significantly between countries, and navigating the requirements for ceasing one’s tax residency can be daunting. Having trusted tax and legal experts by your side can provide peace of mind and help you navigate through these complexities.