WEBINAR | EXPAT TAX 101

TAX RESIDENCY IN THE UAE

A WEBINAR FOR SOUTH AFRICAN EXPATS

- 14 March 2023 16:00 (SA Time)

- On your PC via Zoom

- Free

TAX RESIDENCY IN SOUTH AFRICA

South Africans with certain skillsets are in high demand overseas, while others are eager to immerse themselves in the international job pools to gain first-world experience. Whatever the incentive, many people are considering work opportunities abroad.

This could be a lucrative decision, but job seekers seldom follow the correct procedures to ensure compliance with the South African Revenue Services (SARS), nor do they fully comprehend the implications on their personal tax. To understand why it might be better to cease your tax residency in South Africa, let’s look at what is meant by an individual’s tax residency status.

What is tax and non-tax residency?

The SA tax system is a residence-based system. In terms of the residence basis of taxation, any South African tax resident will be subject to tax on worldwide income and capital gains. Income tax is levied at progressive rates on an individual’s taxable income for the year, which is calculated by subtracting allowable deductions and exempt amounts from gross income.

Non-tax residents (non-residents) are taxable only on South African-sourced income and capital gains resulting from the disposal of immovable property in South Africa. Looking at the difference between the two statuses, it might be wise to apply for a non-tax residency. Remember to consult an emigration or taxation specialist before making this decision.

How to determine your tax residency status?

South African tax residency is determined using two primary tests, as outlined by the South African Revenue Service (SARS). The first is the ordinarily resident test, which assesses whether an individual’s permanent home or habitual place of residence is in South Africa. If it is conclusively established that a person is not ordinarily resident in South Africa, then the physical presence test is applied as a secondary measure to determine tax residency status. (Source: SARS – Interpretation Note 3, Issue 2)

If you are ordinarily resident, you cannot simply cease your ordinary tax residence by not being physically present in South Africa. In fact, your absence from South Africa has no bearing where your tax residence is being evaluated. You will be regarded a tax resident of SA if you are physically present in South Africa for a period or periods exceeding:

91 Days in total during the year of assessment under consideration.

91 Days in total during each of the five years of assessment preceding the year of assessment under consideration.

915 Days in total during those five preceding years of assessment.

An individual who fails to meet any of these requirements will not satisfy the physical presence test. In addition, any individual who meets the physical presence test, but is outside SA for a continuous period of at least 330 full days, will not be regarded as a resident from the day on which they ceased to be physically present. If the individual is neither ordinarily resident, nor meets the requirements of the physical presence test, that individual will be regarded as a non-resident for tax purposes.

According to the South African Revenue Service (SARS), an individual who fails to meet any of the requirements of the physical presence test will not qualify as a tax resident of South Africa. Additionally, if an individual meets the physical presence test but is outside South Africa for a continuous period of at least 330 full days, they will cease to be a tax resident from the day they left South Africa. In such cases, the individual will be regarded as a non-resident for tax purposes from the day they ceased to be physically present in South Africa.

For more detailed information, you can refer to SARS’s official page on Tax and Non-Residents and the page on Cease to be a Resident.

Do I qualify to cease my tax residency?

To cease your ordinary tax residence in South Africa, the following two requirements need to be present:

- An intention to become/cease being ordinarily resident in a country.

- Steps indicative of this intention having been or being carried out.

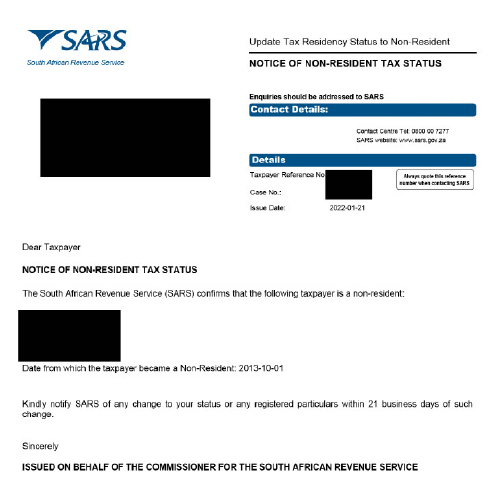

How do I cease my tax residency?

If you meet the qualifying criteria, then you may submit a declaration to SARS (South African Revenue Service) to change your status. However, determining or ceasing your tax residency is often not a clear-cut case. More than that, it can be a lengthy and complicated procedure. The simplest, and safest, course of action is to obtain the services of a tax or immigration specialist before deciding what route to take. A knowledgeable consultant can guide you through the pitfalls and assist with ceasing your tax residency. If your earning structure or immigration process is a bit more complex, choose a practice that houses extensive legal experience under the same umbrella.

FAQ – Cease South African Tax Residency: Your Questions Answered

- For South African expatriates, ceasing tax residency means you no longer regarded by South African Revenue Service (SARS) as a tax resident of South Africa. This happens only once when you leave South Africa and have formally notified SARS by way of an application to cease tax residency. After ceasing tax residency, SARS taxes you only on the income that is sourced from within the borders of South Africa.

- SARS uses two main tests: Ceasing to be an Ordinarily Resident taxpayer, alternatively by way of the application of a Double Taxation Agreement (DTA). If you don’t meet either (e.g., you live abroad most of the year and no longer have a permanent home or substantial ties in South Africa), you can cease tax residency by informing SARS and submitting required documentation.

- You must file a final tax return declaring your worldwide income up to the date you ceased tax residency. This helps SARS assess any tax liabilities, including possible exit taxes on your global assets.

- South Africa has tax treaties with many countries to prevent double taxation. Once you cease residency, you may pay tax in your new country of residence. Proper planning and treaty application ensure you’re not taxed twice on the same income. For more information click the like to find out more Double Taxation Agreements & Protocols

- Maintaining significant ties, like property or family in South Africa, can complicate your tax residency status. SARS looks at all personal and economic ties when determining residency, so it’s important to get professional advice to understand your situation.

Need to Confirm Non-Residency with SARS? We Can Assist!

Navigating SARS requirements can be complex. Let our experts assist you in confirming your non-residency status with SARS to ensure you meet all legal obligations and avoid unnecessary tax liabilities.