SARS Non-Residency Verification Risk For Expats Filing 2024 Tax Returns

As a South African living abroad, you might assume that your tax affairs are in order. However, recent changes by the South African Revenue Service (SARS) require immediate attention to your non-resident tax status.

Before submitting your 2024 tax return, it is crucial to ensure that your non-resident tax status is correctly aligned with SARS. Where your tax affairs are not in order, the consequences can range from a full SARS audit, SARS additional tax assessments being raised without prior knowledge, SARS penalties, issues with any South African banking and just a whole range of other problems which can be avoided.

Delano Abdoll

Legal Manager: Cross Border Taxation

Nikolas Skafidas

SARS Tax Compliance and Process Supervisor

Featured in

The Challenge to give “Proof” of your Tax Non-Residency

Many expats who are eager to update their tax status to non-resident have reached out to our firm after receiving an unexpected letter from SARS. This letter is a request for relevant supporting documents as proof of their change in tax status. These SARS requests have stemmed from a prior declaration on their SARS eFiling profile, highlighting the importance of the need for up-to-date and relevant supporting documentation.

The question arises: Will your “Emigration Confirmation Letter” issued by South African Reserve Bank (SARB) prior to March 2021 suffice as proof of tax non-residency? Unfortunately, this will not. SARS has introduced stricter verification processes, requiring more thorough documentation. This “Emigration Confirmation Letter” alone is no longer sufficient supporting evidence for expats to file their tax returns on a non-resident basis.

SARS Shifting the Goalposts for Expats

SARS is notorious for shifting the goalpost for expats. The most recent shift being the change of requirements for expats, necessitating re-verification of your non-resident status on eFiling. This additional step is now required to ensure accurate tax submissions in the future. Non-compliance with this process means you will be treated as a tax resident on SARS’ official records, leading to automatic assessments and penalties.

As diligent taxpayers who previously followed the correct procedures, it can be frustrating to face this new requirement. Nonetheless, adapting to these changes and verifying your tax non-resident status remains essential.

The Critical Role of following through and acting on SARS Notifications

SARS has reset the tax residency status of many South Africans living abroad to “resident” on their eFiling profile. Even if you previously ticked the non-resident box or obtained a Tax Clearance Certificate for Emigration and SARB confirmation letter, it is crucial to update your tax residency status to reflect your cessation date.

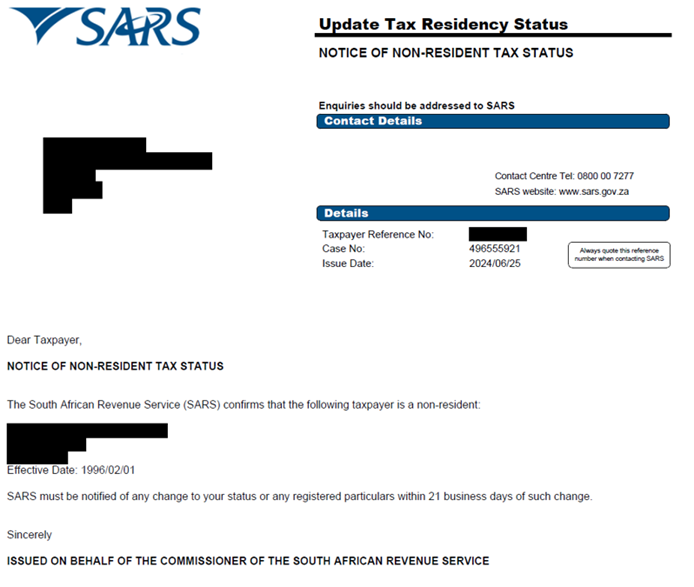

Receiving a tax-residency verification request from SARS is not a request to be taken lightly and is a crucial step that requires immediate action. Addressing this request promptly is essential to ensuring that your tax non-residency status is formally noted by SARS. Once the relevant supporting documents are submitted and upon successful completion of the SARS verification process, SARS will then formally update your tax residency status on your eFiling profile to “tax non-resident” and issue you a Notice of Non-Resident Tax Status confirmation letter.

This letter essentially confirms that you may now submit your tax returns as a tax non-resident in South Africa and is necessary for any future non-resident tax return submissions.

Next Steps for Verification

If you previously ceased your tax residency under the old regime, the immediate step is to apply for the SARS Notice of Non-Resident Tax Status Confirmation Letter. This verification request is not only a warning but also an opportunity to prevent potential tax risk and non-compliance. Our expat tax experts are here to help you navigate this complex process and ensure a smooth transition to tax non-residency compliance.