YOUR SOUTH AFRICAN RETIREMENT SAVINGS AND THEIR TAX IMPLICATIONS

The National Treasury and SARS have introduced many changes to the treatment of South African retirement vehicles which have often resulted in adverse tax implications and penalties for early withdrawals, or strict rules and regulations applied. The aim of this was to incentivise South Africans to be more forward thinking and to encourage the provisioning of adequate savings for retirement.

Specialist Legal Consultant: Expatriate Tax

Processing Supervisor

These changes presented themselves differently with each financial quarter, and to understand the new path set forth by National Treasury for retirement vehicles, we first must take a stroll through the genesis of the changes made over time:

- Previously, the three types of retirement funds (pension, provident, and retirement annuity funds) had different caps and deduction bases applied to them. In an effort to harmonise the tax treatment of these different types of funds, and with effect from 1 March 2016, the legislation was amended to allow for a 27.5% tax deduction, up to a maximum of R350 000 per annum, for all retirement fund contributions.

- In March 2021, an amendment was enacted that required those retiring, to purchase an annuity with a portion of their pension or provident fund interest, to preserve the retirement funds. This further evidenced Treasury’s attempt to create uniformity among these retirement vehicles. However, there were still restrictions in terms of the annuities that could be acquired upon retirement.

- For taxpayers who emigrate, a 3-year lock-in period on all retirement funds was introduced, before an expatriate could withdraw their retirement interests. Previously, individuals ceasing tax residency in South Africa (i.e., undergoing a residency cessation / financial emigration process) could withdraw their retirement funds, in full, upon the formalisation of their residency cessation. With effect from 1 March 2021, their retirement benefits were locked in for a minimum period of three years, after which they could be fully withdrawn (subject to lump sum tax implications). Simply put, one must have been non-resident for a minimum of 3 years, as confirmed by SARS, before they can qualify to withdraw their retirement interests in full.

- The resultant requirements for withdrawing locked in Retirement benefits included the furnishing of a Tax Clearance Status (TCS) PIN, issued by SARS, to gain access to the funds and successfully withdraw. However, the PIN would expire after 12 months. Recently, and after the controversial SARS tax residency status “reset”, a SARS-issued Notice of Non-Resident Tax Status Letter has become an important requirement as well – this letter has no expiration date.

- In March 2022, the Taxation Laws Amendment Act (TLAA), which introduced amendments to the tax laws in South Africa, increased the flexibility for a retiring member by expanding the types of annuities a member can purchase upon their retirement, thereby allowing the use of retirement interests to acquire annuities.

- Further targeted at those ceasing tax residency, a proposal was suggested to implement a tax levy on retirement interests of individuals upon the cessation of their South African tax residency. After vehement opposition to this by industry stakeholders and the Expat Tax Petition group, this proposal was scrapped, which was confirmed with the promulgation of the TLAA.

As expected, each of these changes have created difficulties for South Africans (including expatriates). South Africans were still unable to access their funds without adverse tax and penalty implications, and many of those who required urgent access to these funds sacrificed their employment and, ultimately, their retirement security.

Expatriates subjected to the 3-year lock-in period, are no longer able to utilise their funds to assist with the financial hardship associated with emigration and their new ventures, and would still fall within the South African tax net, post-emigration.

In a continuous effort to strike a balance between individual financial hardships and the need to maximize savings for retirement, a revamp of retirement benefits was proposed to the public for comment.

New pots on the block

In December 2021, the South African government published a discussion document proposing a new retirement regime that aims to improve the lack of provision for retirement, and also alleviate financial distress in households that have assets encumbered in their retirement benefits.

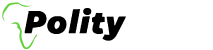

With effect from 1 March 2023, Fund Administrators will create a new ‘retirement pot’ and ‘savings pot’ that each can receive retirement contributions. All prior contributions and related growth will have to be valued on 28 February 2023 to enable the vesting of rights and with a ‘vested pot’ created to accommodate these into the new system. To give effect to this, new proposed definitions are to be included in section 1(1) of the Income Tax Act. Among other legislative amendments, accommodating for this change, access to the ‘savings pot’ will be allowed once, during any 12-month period, and a minimum of R2 000 must be withdrawn if a savings withdrawal is made.

The new two pot retirement system comes with new tax treatment proposals, which fall just shy of creating the uniformity it seeks. Simply put, withdrawals from the vested pot will be taxed in accordance with the pre-1 March 2023 tax provisions. All annual withdrawals from the ‘savings pot’ will be included in the individual’s gross income and taxed at their marginal income tax rate. The retirement pot will be locked in until retirement and will be taxed in accordance with the usual lump sum withdrawal tables.

In a nutshell:

So where to from here?

As commendable as National Treasury’s attempt to consolidate the position on retirement benefits is, the two-pot system adds immense complexity to the tax treatment of policy withdrawals.

For expatriates who have either ceased South African tax residency prior to the enactment of this system, or have done so after the enactment, or who still plan to cease their tax residency, it has now become a requirement to acquire both the Notice of Non-Resident Tax Status Letter and the Tax Compliance Status (TCS) PIN before the amounts may be released (and sent abroad).

Although, with the new proposition, these will still be important requirements, and the complexity of the tax treatment of retirement interests suggests that consultation with experts is necessary to ensure a smooth, efficient and compliant approach is taken in each case.